Customer pulse survey: How COVID-19 has affected advertisers this summer

It’s no secret that the COVID-19 pandemic has had a major impact on advertisers. Brands in certain industries like Travel have cut their advertising efforts entirely. Others chose to block advertising alongside content related to the virus, significantly reducing their reach. And nearly all marketers had to pivot their strategies to reach people isolating at home and adjusting to this new normal.

While the global outbreak has brought many challenges, it’s also presented many new and unexpected windows of opportunity. This summer, we surveyed our advertiser partners to understand the effects of COVID-19 has had on their business.

Here are the major trends that we discovered.

Overall, sales are steady

People haven’t been afraid to spend while quarantining. Consumers have increased purchases across certain categories while shying away from others. 62% of marketers have seen an overall increase in their sales because consumers buy more of what they sell during this time.

- Based on survey responses, the advertiser category that has seen the largest majority increase in sales is Technology, Software, and Computing.

- This statistic remains constant with another recent analysis led by LiveIntent, written by Jessica Muñoz, which reported a 460% increase in conversion rates for Technology and Computing advertisers since the start of quarantine in March of this year.

But this is not the case for all marketers.

- 38% of marketers have seen a decrease in their overall sales, reporting that consumers are buying less of what they sell during this time.

- The advertiser categories that have been affected the most are Retail and Travel.

As people shelter in place, marketers have understandably seen an increase in sales from online stores and a decrease in sales from brick-and-mortar stores.

- 51% of marketers report an increase in online sales

- 19% report that in-store sales have declined.

- A recent report by eMarketer, written by Andrew Lipsman, forecasts that “US ecommerce sales will rise by 18% to $709.78 billion, while brick-and-mortar retail sales will experience a historically significant decline of 14.0% to $4.184 trillion.”

Companies are adjusting their advertising strategies

Changes in sales and consumer spending have prompted marketers to shift their advertising investments. This way, they can meet changing audience behaviors and shift funds as needed to keep their businesses running.

80% of marketers have increased their advertising investment since quarantine began.

- An article by Shane Schick on Marketing Dive states that video conferencing software brands under the Technology, Software, and Computing category saw a spike in ad spend to $45 million.

But 20% of marketers have decreased their advertising investment to reallocate their marketing budget to meet other business needs.

- A trend report by MediaRadar specifies that between April and June of 2019, US department stores averaged $11.6 million per week on ad spend. Since COVID-19, ad spend from the retail category from April to June only averaged $2.1 million per week.

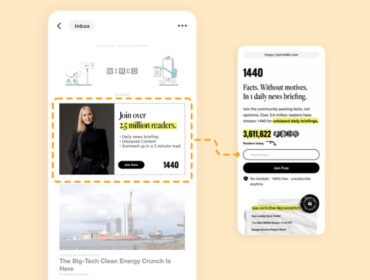

Interest is growing in certain channels

Marketers have a range of channels to choose from – email, display, video, search, social, and more. As consumer habits continue to evolve, and budgets are reworked during these uncertain times, advertisers are increasing investments in their most valuable channels.

B2B brands are especially focused on increasing their investment towards email and programmatic display, video, and native.

- 73% of B2B marketers are increasing their investment towards email.

- 45% of B2B marketers are increasing their investment towards programmatic.

D2C brands are especially focused on increasing their investment towards paid search and paid social.

- 45% of D2C marketers are increasing their investment towards paid social.

- 42% of D2C marketers are increasing their investment towards paid search.

A look towards the future

Beyond COVID-19, advertisers are exploring various strategies to ensure they can continue acquiring and retaining customers. With the death of the third-party cookie on the horizon, many are also searching for solutions that can help them gather first-party data and build owned audiences.

- 75% of marketers will modify their use of different advertising channels.

- 65% of marketers want to prioritize their customer acquisition and retention strategies.

- 43% of marketers will focus on audience targeting solutions to replace third-party cookies.